You don't have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time. – Charlie Munger

In the 1980s, the market for high-yield bonds (aka junk bonds) experienced a dramatic boom. This was fueled by new deregulations in the finance industry and an increasing appetite for corporate takeovers. The junk bond market grew exponentially from a minuscule $10 billion in 1979 to a whopping $189 billion by 1989 - with yields averaging around 14.5%!

Unsurprisingly, given the market conditions and high inflation of the 80s, investors were drawn to these high-yield junk bonds. Ben Trotsky was a bond manager working for Pacific Investment Management Company (PIMCO) during this time. Even though he was deeply skeptical about junk bonds, he devised a brilliant strategy for investing in junk bonds that he called “Strategic Mediocrity”

In his job as a bond manager, he had to beat the benchmark to get investors interested in his fund. What this means is that he was competing with hundreds of other money managers who were playing the same game. They all got ranked from best to worst – every day, every year, every five years, and so on.

What Ben decided was that he never wanted to be first in a particular year. Because anyone who ever got the No.1 rank almost certainly got it because they did something reckless, tried really hard, or took really big swings. They must have taken too much risk and it worked out in their favor that particular year – but, luck eventually runs out. When he did simulations of various long-term scenarios, everyone who showed up in the top slot eventually dropped out of the long-term rankings. But, if you stayed among the top 1/3rd consistently for a decade, you would end up in the top 10% of fund managers.

That’s the beauty of Strategic Mediocrity. You never risk it all trying to generate the highest possible return in a given year. You play it safe, do well but not too well & try to be in the top 30% of the fund managers every year. That means not buying the scariest junk bonds that could have the biggest payoffs but going for one of the barely junk ones. While other fund managers were caught off guard by the collapse of the junk bond market in the late 80s, Ben was able to weather the storm and emerge as one of the most successful fund managers in history. PIMCO now manages more than $1.7 trillion in assets!

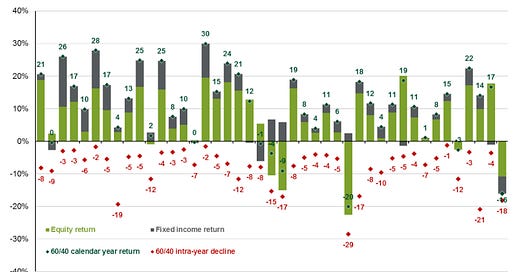

The closest to strategic mediocrity in the stock market would be the 60/40 portfolio. The idea is simple – you put 60% of your money in stocks and the other 40% in bonds. It’s the safe mundane way of investing without taking too much risk. By investing in both stocks and bonds, you improve your diversification and reduce the volatility of your portfolio. It is usually considered the gold standard for portfolios as it’s simple to build, robust in most cases, and provides adequate diversification.

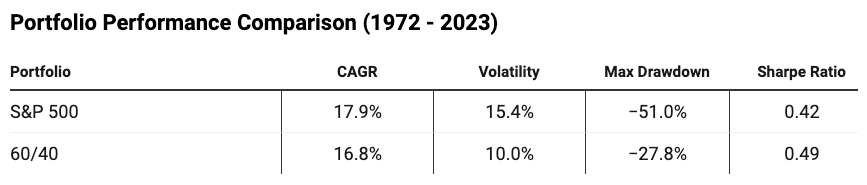

To see how good the 60/40 portfolio is, let’s check its performance compared to the S&P 500 over the past 50 years.

The simple 60/40 portfolio is able to generate a very comparable performance to the S&P 500 while having significantly lower volatility, drawdown, and a better Sharpe ratio!

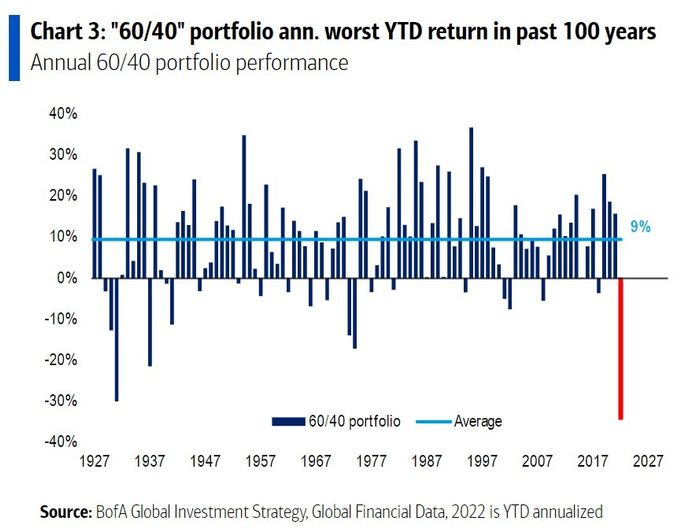

But 2022 changed all that. With raging inflation, the Fed hiking its interest rates at the fastest rate in history, and the stock market in deep red, at one point in 2022, the 60/40 portfolio had its worst return in the past 100 years.

To see how rare it is for both stocks and bonds to go down, till 2022, there were only 3 years on record where bonds didn’t go up when stocks went down. Think about that for a minute – over the past 90 years, stocks and bonds were down together only 3 times!

In classic fashion, just one year of significant underperformance was enough for the media to state that the 60/40 is dead and we should be replacing it with something better.

The more sensible assumption would be that a once-in-a-blue-moon bad year for bonds doesn’t invalidate decades of data and right now would be one of the best times in recent history to get into the 60/40 portfolio based on valuation parameters (bonds now pay their highest yields in more than a decade). Data backs this up: Based on normal risk-return relationships since the advent of modern bond-market data in the 1970s, the typical 60/40 portfolio’s extreme losses in 2022 had a probability of occurring only once in every 130 years!

So let’s dig into what happened in 2022 to find out – Is the 60/40 dead as the media claims it to be, and what does the future hold?