3 Fund Portfolio

The majesty of simplicity

Does the Three-Fund portfolio seem overly simplistic, even amateurish? Get over it. Over the next few decades, the overwhelming majority of all professional investors will not be able to beat it. - Bill Bernstein, author of The Four Pillars of Investing

In the early 20th century, the paper clip was a complex and often frustrating tool. There were dozens of different designs, each with its own quirks and flaws. Some clips were too weak and would bend easily, while others were too strong and would damage the paper they were holding. Some clips were too difficult to insert and remove from the paper, while others were too easy to accidentally dislodge.

In 1901, a Norwegian engineer named Johan Vaaler1 decided to simplify the design of the paper clip. He came up with a design that was simple, elegant, and efficient. His clip was made from a single piece of wire, bent into a loop with two long, straight ends. The wire was strong enough to hold the paper securely but flexible enough to be easily inserted and removed.

Vaaler's design quickly became popular and is still used today, more than 90 years later. Despite numerous attempts to improve upon it, no one has been able to create a better design for a simple, effective paper clip. Similarly, in investing, what is complicated is rarely the right approach.

Successful investing comes down to just three core principles: diversification, low costs, and discipline. By investing in a diversified portfolio of low-cost index funds and sticking to a long time horizon, individual investors can achieve excellent long-term returns without taking on unnecessary risk.

The 3-fund portfolio is one of the best examples of asset allocation that meets all the criteria for successful long-term investing.

What is the 3-fund portfolio?

At its core, the 3-fund portfolio is built using just three market index funds –

Total U.S. Stock Market

Total International Stock Market

Total Bond Market

While we don’t have to tell you the importance of having U.S. stocks in your portfolio, it’s crucial to understand why the 3-fund portfolio has exposure to the international stock market and the bond market.

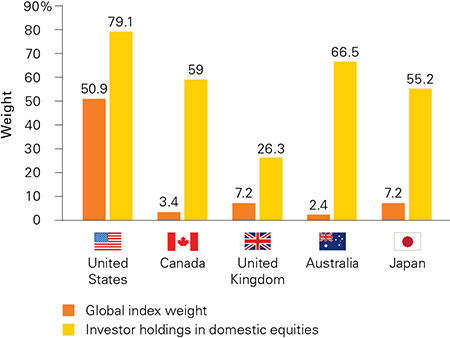

Avoiding the home country bias with international stocks

When it comes to investing, investors are very reliant on the market in their home country. Investors irrationally expect higher returns in their domestic market compared to other markets. The U.S. stock market only constitutes about 50% of the global market but on average U.S. investors allocate 80% of their portfolio to U.S. companies. The proportion is even more skewed in the case of smaller countries such as Canada and Australia. Canadians allocate ~60% of their portfolio to the Canadian market while it only constitutes 3% of the global market.

The U.S. stocks have performed phenomenally well in the last decade but that does not mean it’s going to last forever. Since 1975, the outperformance cycle for the US versus international stocks has lasted an average of 7.8 years. Currently, we are in a place where the local stocks are outperforming the international ones. The tide can and will turn some day.

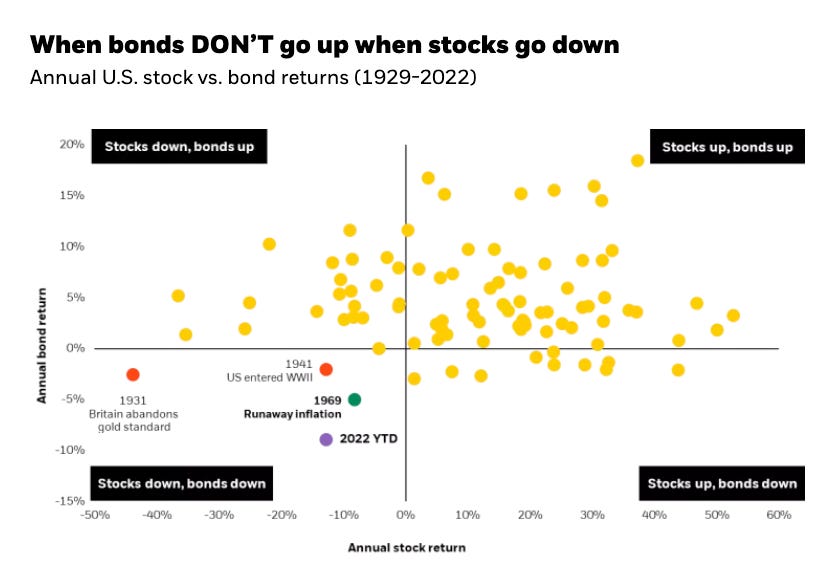

Cushioning the inevitable downturn with bonds

Over the past 90 years, stocks and bonds were down together only 4 times. Even though bonds cannot match the stock market returns, the steady and predictable cash flow is a huge boon during stock market downturns.

For example, during the Subprime crisis of 2007, if you had 100% stocks, your portfolio would have been down by a harrowing 51% whereas if you had a 60/40 portfolio, you would have only been down by 26%.

Now that you have a flavor of why international diversification and bonds are important, let’s dig into how to build the 3-fund portfolio, what proportions each segment should have, and how the 3-fund portfolio has performed over the last 4 decades:

(Just a reminder: we are offering a 20% discount on our annual subscription)