Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 47,000 other investors to make sure you don’t miss our next briefing.

Exactly 25 years ago, in April 2000, the dot-com bubble burst. The writing had been on the wall for some time. But in the euphoria of the internet age, rationality was the first casualty.

On its IPO day in 1996, Yahoo's stock price went up 153%!

The Nasdaq index had a P/E valuation of 200x

In just one year (‘99), Qualcomm shares rose by 26x

Investors expected an annual return of 23% over the next ten years.

The dot-com bubble coincided with the longest period of economic expansion in the U.S. since World War II. It looked like nothing could go wrong. And then it did.

Just after peaking in April 2000, Nasdaq lost 34% of its value within a month, and by the time it bottomed out in October 2002, Nasdaq had lost nearly 80% of its value.

This type of irrational exuberance is a feature, not a bug — in the paper "Two Centuries of Innovations and Stock Market Bubbles," researchers analyzed the probability of a bubble forming for new innovations. They found that across the 51 major innovations introduced between 1825 and 2000, stock market bubbles were formed in 73% of the cases. The more radical the innovation, the larger the magnitude of the eventual bubble.

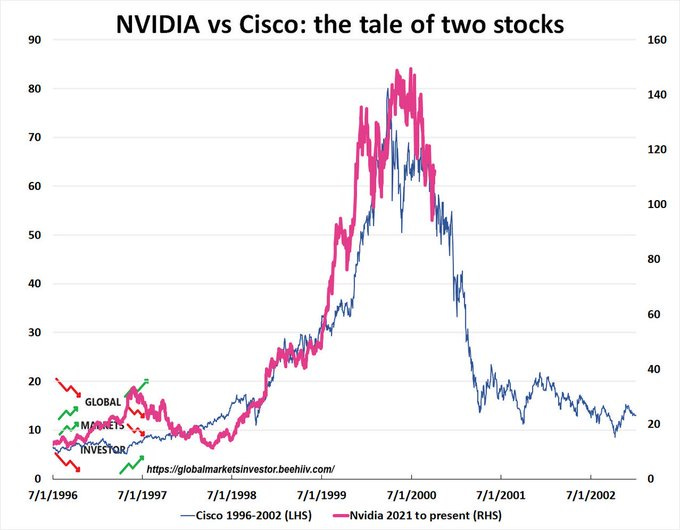

That brings us to AI. There have been growing concerns whether the current hype associated with AI is leading us into another dot-com bubble, with some highlighting Nvidia as the next Cisco.

On the 25th anniversary of the dot-com bubble bursting, it’s worth asking — are the Magnificent 7 and AI stocks driving us into another bubble, or is this time truly different?