Welcome to the 600+ investing enthusiasts who have joined us since last Sunday. Join 27,660+ smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

History Doesn't Repeat Itself, but It Often Rhymes – Mark Twain.

I distinctly remember the first time I used a full touchscreen phone. While the larger display was a welcome change from the Nokia N72 I was using, the experience was definitely subpar. The screen was not responsive, multi-finger gestures rarely worked and typing on it was a nightmare. I came away from the experience 100% sure that touchscreen phones were a passing fad and not the way forward for smartphones.

It was just not me that was complaining about the touchscreens. A Bloomberg reporter complained to Steve Jobs that the iPhone keyboard “doesn’t work” and that the keys were too small for her thumbs. Jobs just smiled and then replied: "Your thumbs will learn."

More than a decade has passed since the first iPhone was introduced and we all know which direction smartphones went. It’s extremely hard to make long-term predictions - Here are some of the classic examples of wrong predictions made by extremely smart people.

I think there is a world market for maybe five computers - Thomas Watson, President IBM

The subscription model of buying music is bankrupt. - Steve Jobs

Cellular phones will absolutely not replace local wire systems - Marty Cooper, developer of the first hand-held phone

On the first day Bill Gates met Warren Buffett, Buffett introduced him to his favorite critical thinking exercise that helped him spot long-term trends and stay grounded on the pace of change occurring around us. In this deep dive, let’s recreate the same exercise using the last 4 decades of data. After all, one of the best ways to predict what’s going to happen in the future is to study what’s already happened. What was Buffett’s exercise?

The 1980s

Now, back to it: Buffett’s exercise is simple - You choose a random year, say 2000, and then examine the top 10 companies with the largest market capitalization. Then you go forward 10 or 20 years and then see how those companies fared over time. This will help us spot emerging trends, what types of companies create enduring success, and how technology advances and cultural norms shape businesses.

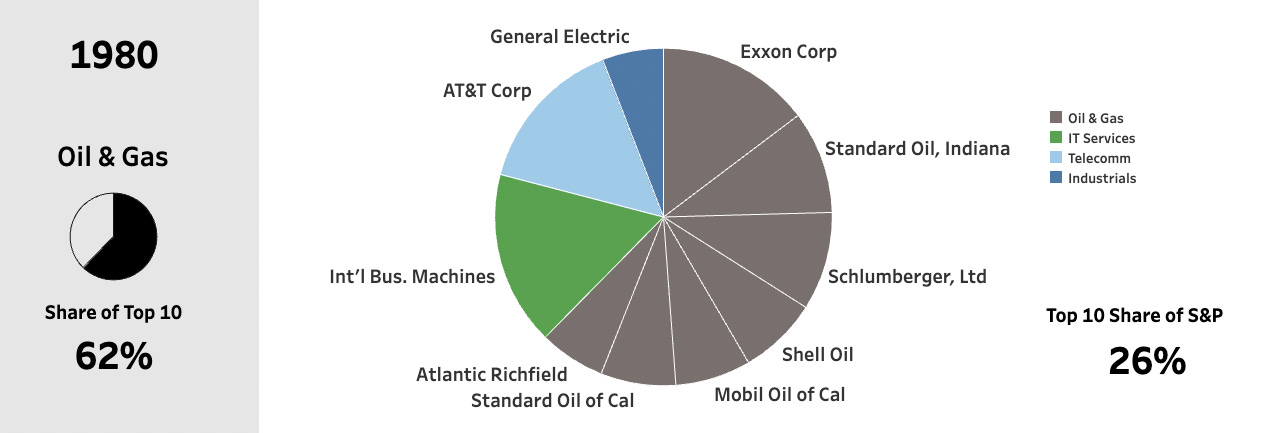

We are starting our analysis in 1980 where Oil and Gas companies dominated the top 10 list.

IBM was the biggest company back then, closely followed by AT&T. What’s incredible is that the next 7 companies1 were all Oil & Gas (Contributing to ~ 16% of the S&P500). The key factor driving the valuation was the high Oil Price - over US$35 per barrel (equivalent to $115 per barrel in 2021 dollars, when adjusted for inflation).

But this did not last long. The 1980s Oil glut caused oil prices to drop to below $10 by the end of 1986. By the beginning of 1990, only one oil company (Shell) was in the top 10 list. It shows you the importance of avoiding cyclical companies as a long-term investment.

The 2000s

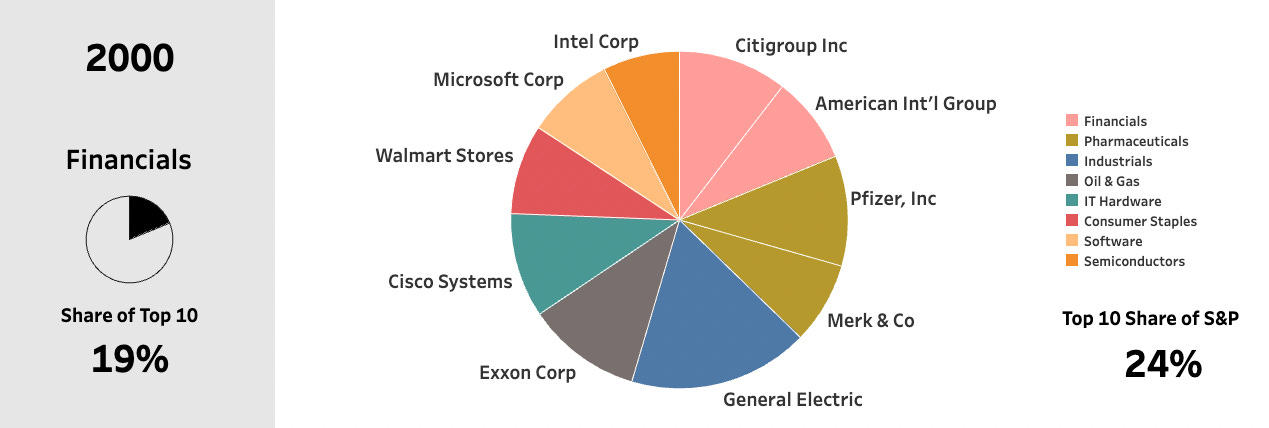

The few years leading up to the millennium were incredible for tech companies and 2000 was the peak of the dot-com bubble. Companies with non-existent revenue were valued at Billions of dollars and just being associated with the ‘internet’ was enough to have investors lining up.

But, no one industry dominated the top 10 list. It was a good mix of tech, pharma, consumer staples, and industrials. The biggest one was Financial services2 but it only took ~20% of the top 10. What’s amazing is that only two companies (Exxon & GE) from the 1980s list made it to 2000. Even IBM had dropped out of the top 10 list even though we were in the middle of the dot-com boom.

The 2020s

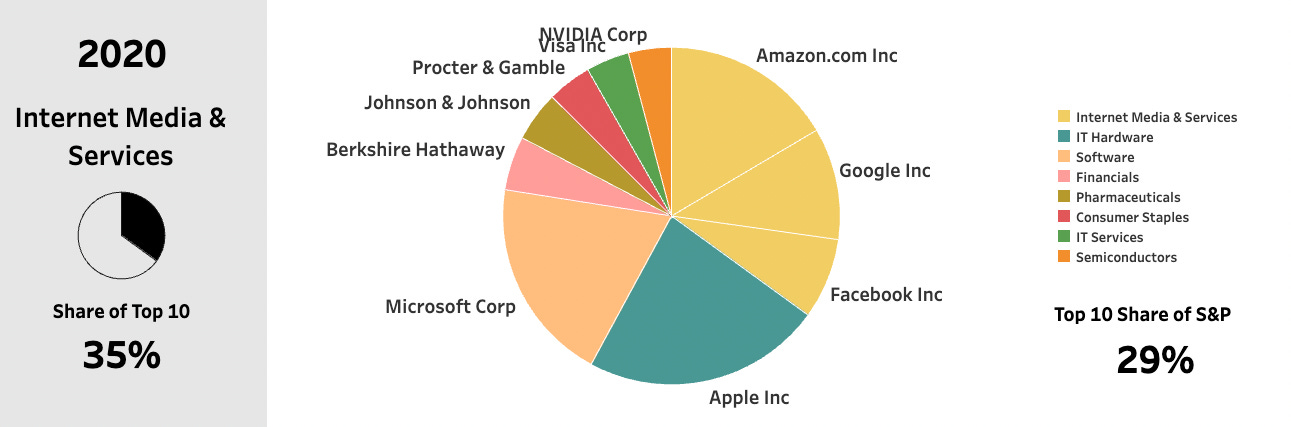

Finally, we come to the present. It’s the era of big tech with 7 out of the top 10 companies closely related to tech.

Apple, Amazon, Google, and Microsoft continue to dominate the respective industries they are in and are virtual monopolies. Once again, only one company (Microsoft) from the 2000s and not even a single one from the 80s made it to the 2020 list3.

Another interesting aberration from previous decades is that the largest stocks are also the biggest winners4 in the market creating exceptional returns. Ned Davis Research wrote a piece a few years ago that showed from 1972 to 2013 the S&P 500 was up close to 5,000% but if you would have owned just the biggest stock in the index every year you would have only gained around 400%. Only time will tell if the current growth of tech stocks is sustainable.

The 2040s?

The inability to forecast the past has no impact on our desire to forecast the future. Certainty is so valuable that we’ll never give up the quest for it, and most people couldn’t get out of bed in the morning if they were honest about how uncertain the future is. - Morgan Housel

We have barely scratched the surface of this exercise. The last 4 decades have brought spectacular changes to the markets and trying to predict the next few decades does look like a fool's errand. But looking at the data, we can spot some trends.

Oil & Gas has lost its sheen and it’s unlikely that it will come back to its glory days like in the 80s as we move more and more towards alternative energy sources.

Cultural changes can bring down empires - Tobacco maker Philip Morris was the 4th largest company in the world in 1990 but now it’s at 75th position due to ever-increasing smoking bans and awareness.

Monopolistic and agile companies tend to survive longer - Microsoft is still in the top 10 after 2 decades due to its monopoly in the enterprise and personal computing space and GE was present in the list from the 1980s to 2015 due to its presence in multiple industries and markets.5

Now for the fun part - Given all that we have seen, if you have to bet on one company that will still be in the top 10 list in 2040, which one would it be?

You can find my prediction and rationale in the comment section.

More Interesting Stuff

Daily Chartbook - It’s very hard to stay on top of the markets with all that’s happening around us. After every closing bell, Daily Chartbook curates the best of the day’s market insights & charts and delivers them to you in an easy-to-digest, visual review to help investors maintain their edge.

Footnotes

Interesting bit of history - At the beginning of the 1900s almost all the oil (~85%) was controlled by one company - Standard Oil. The Sherman Anti-Trust Act broke up Standard Oil into 33 different companies. The crazy part is that back in 1933, Standard Oil company was granted rights to search for Oil in a little country called Saudi Arabia. They formed a joint venture with the Saudis and they called it Arabian American company aka Aramco. It's the biggest company in the world now.

Not so fun fact - Both Citigroup and AIG were in the top 10 list in 2000. These companies were responsible for taking down the entire financial industry during the 2007-8 crisis. After the crisis, the banks barely survived with Citigroup down 86% and AIG down a whopping 95%.

A lot has changed over the past 4 decades and given that we were skipping decades, we have glanced over some important companies that came and went out of the list. Check out the below video for the full list.

Apple, Amazon, Google, and Microsoft all have more than doubled in just the last 5 years. This is incredible considering their already high base valuation

Rohit Krishnan has a great article on companies that never die. It’s a great follow-up to this piece.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

My prediction for 2040 is Microsoft. It's mainly based on two things.

1. The Lindy effect: A theorised phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. (Not a very strong argument)

2. Enterprise customers - Microsoft generates a lot of business from enterprise customers and these are extremely sticky. I don't see Excel, Windows and Outlook being replaced anytime soon.

Apple is a close second due to their ecosystem but for me they are one bad iPhone away from tough times.

🤝